Nationwide Digital Infrastructure M&A Services

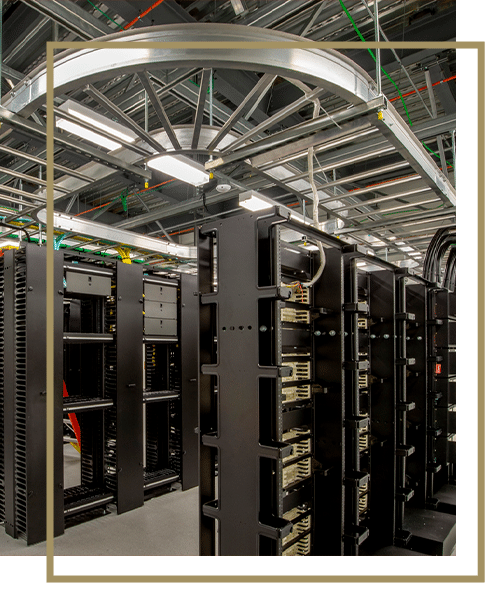

Drachman M&A Co. provides specialized mergers and acquisitions advisory for companies in the fast-growing digital infrastructure sector. With demand for connectivity and bandwidth at historic highs, assets like cell towers, data centers, and fiber networks have become some of the most valuable and strategic investments in today’s economy.

Our team works with business owners, operators, and investors across the U.S. to navigate complex, high-value deals in this evolving space. By combining market intelligence, a strong buyer network, and a hands-on approach, we deliver outcomes that maximize value and position clients for long-term success.

Strategic Guidance for Tower, Data Center & Fiber Transactions

Digital infrastructure deals require more than just financial analysis—they demand technical knowledge, operational understanding, and access to highly specialized buyers. Our firm helps clients structure and execute transactions that reflect the unique drivers of value in this industry, from tenant agreements and capacity utilization to long-term growth potential.

We represent clients across a range of opportunities, including regional fiber networks seeking expansion, independent data centers preparing for sale, and tower portfolios looking to capture peak valuations. Whether you’re divesting a single asset or acquiring a platform to expand your digital footprint, we provide the clarity and expertise to help you succeed.

Leadership Backed by Real-World Results

Drachman M&A Co brings critical experience advising on digital infrastructure and asset-heavy industries. Our team’s background in building and scaling operationally complex networks, data centers, and technology-driven businesses translates directly to the challenges and opportunities facing digital infrastructure companies today.